Esports Viewership Skyrockets: Hours Watched Triple Since 2017

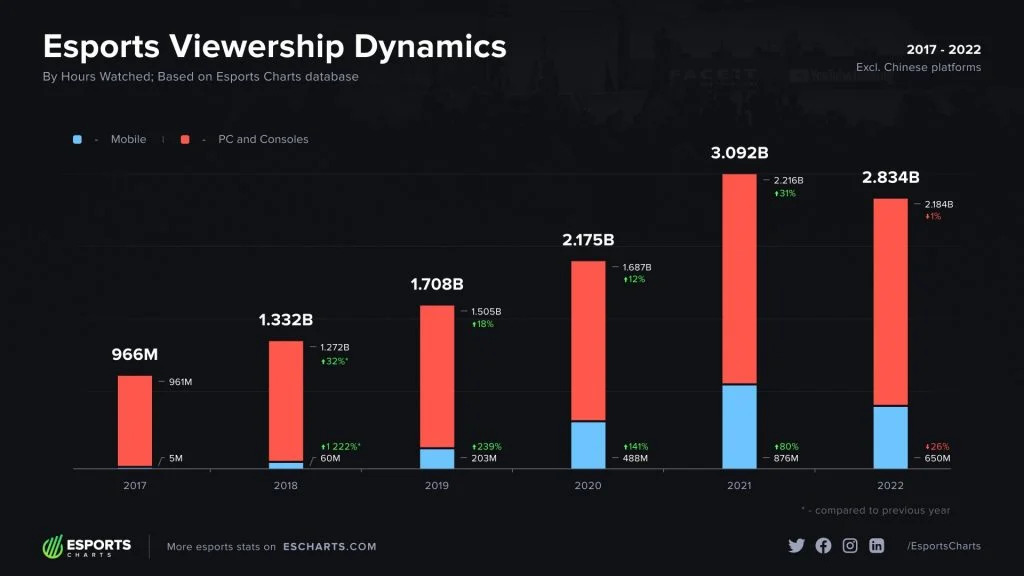

In a groundbreaking report by Esports Charts, a leading esports viewership data platform, it has been revealed that the total number of hours watched for esports tournaments has experienced a remarkable three-fold increase since 2017. The report, which primarily compares viewership data from 2017 to 2022, demonstrates a significant surge from 966 million hours in 2017 to a staggering 2.8 billion hours in 2022 (excluding Chinese viewership). This astonishing growth equates to a roughly 300% jump in esports viewership.

It’s important to note that Esports Charts does not track viewership on streaming platforms in China, which is the largest esports market globally. Measuring data from China poses considerable challenges, thereby resulting in an outsized impact on the statistics, especially for esports titles with substantial Chinese followings, such as League of Legends.

Despite this limitation, esports hours watched exhibited consistent double-digit growth from 2017 until 2021, when it reached its peak at 3.1 billion hours. However, in 2022, there was a slight dip of 6%, bringing the total number of hours watched down to 2.8 billion.

The report identifies India’s ban on prominent esports titles as one contributing factor to the year-on-year decline. However, there is a possibility that this decline may soon reverse, given the recent lifting of the ban on games like Battlegrounds Mobile India.

While esports viewership has generally shown an upward trajectory, the sources of this growth have not been uniform and have evolved over time. The main driver of continued growth has been mobile esports viewership, which surged from a mere 0.5% of total hours watched in 2017 to a remarkable 28% when viewership peaked in 2021.

Notably, this surge in mobile esports viewership has primarily occurred outside of the Western markets, particularly in Southeast Asia, where mobile esports enjoy immense popularity compared to PC-based titles. In Indonesia, for instance, the report highlights that the mobile esports audience has grown five to six times over the past three years, largely fueled by the success of Mobile Legends: Bang Bang.

Furthermore, the report’s findings indicate that the titles fueling viewership growth have naturally evolved. English-language broadcasts of the “big three” esports titles—League of Legends, CS:GO, and Dota 2—saw only a 13% collective increase in their share of hours watched when comparing Q1 viewership between 2017 and 2023. Non-English language broadcasts likely played a significant role in driving these figures upward.

The report concludes, “When it comes to the viewership growth of esports, it is important to understand that the growth of the entire industry is directly related to the growth of its individual segments—and not always those that form the basis of the industry. The largest and worldwide popular games may not grow at the highest rates, while sharp jumps in popularity are made by local games and language segments.”

The surge in esports viewership and the evolving trends in its sources highlight the dynamic nature of the industry. As the popularity of mobile esports continues to soar, particularly in Southeast Asia, and as regional games gain traction, it is evident that the esports landscape is constantly changing and adapting to the diverse preferences of its global audience. With the industry poised for further growth and innovation, esports enthusiasts and stakeholders eagerly anticipate the next chapter in the exciting world of competitive gaming.